Unlike the Nigerian Prince offering a million dollars if you just give him your bank account info, investing is not something that makes you rich overnight. Through discipline and time, you can grow your wealth, but the best way to do that is to invest early and often. Hopefully, after my previous post on the importance of investing to combat rising inflation, people are convinced they want to invest. Some might start by putting it on their New Year’s Resolution for next year, or start when they get that next raise, or when Warren Buffet calls you up to tell you the best time to start, or when the next lunar eclipse happens, but why wait? It is important to start now. The reason for this is the combination of extra time and compound interest – two of the most powerful tools for building one’s wealth.

Most people understand how compound interest works at a high level. You invest, hopefully your investment grows, you make more money, and you re-invest the additional money so it can in-turn continue to grow. This means that your money could be making money while you nap, eat, watch that 8th straight Netflix episode, or share a frosty Budweiser with Peyton Manning. Over time, you will be able to make your money work for you and snowball in to future success.

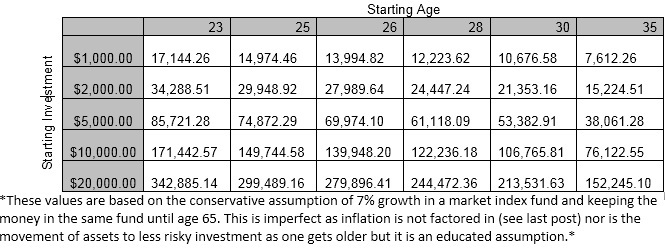

So compound interest is great, right? One thing people have trouble grasping is just how great and powerful compound growth can be. A fun mathematical problem that some of you might have heard is if you put one grain of rice on the first square on a chessboard, doubled it for the second square (2 grains), doubled that on the third square (4 grains), and continued doubling for the whole chessboard (64 squares) how many grains are on the chessboard? I thought a lot, but not 18,446,744,073,709,551,615 pieces of grains. I don’t even know how to say that number, wow! Now we won’t be making that much money, but utilizing a similar compound growth strategy where one gain helps increase the next gain can be advantageous. The important thing to highlight here is the significance of investing early and often. The earlier, and more, you invest the more it will have time to compound on a larger sum. I have included a table below that shows the difference in wealth at age 65 when comparing between different starting years and also investment amounts. The thing to really analyze is how big of a difference it makes waiting 1, 2, and 5 years on the final outcome.

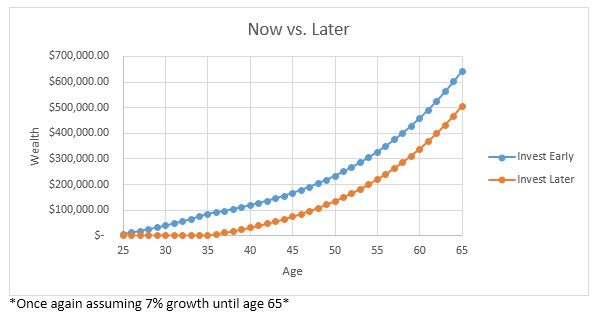

Now, if you are like some of the population and see all those numbers and think, ‘Nope too many numbers, keep scrolling – this isn’t Math class Matt’, then here is a visual example for you. Let’s say you have a friend named Dwight who is odd, but disciplined, and invests $5000 dollars from the age of 25-35 and then stops. He is the early investor in the blue line. You have another friend, Michael, who is funny but flaky, and he doesn’t start early but attempts to make up for it by investing $5,000 from age 35-65. So Dwight put in $50,000 (10 years x 5,000 each year) of his own money while Michael put in $150,000. It should be easy to say Michael ended up with more at age 65, right? Well look at the graph.

Since Dwight invested early and used compounding interest to build his wealth over a longer period of time, he ends up with more money even though he put in 1/3 of the amount (50,000 vs. 150,000). I think this is an eye-opening example for people to think about as they plan their financial future.

At this point most people see the value and the opportunity of investing early and are ready to ask Compound Interest to be their Valentine. Unfortunately, just like that beautiful former boyfriend/girlfriend who turns out to be all types of crazy, there are some watch-outs. First, we used the assumption of 7% growth as a best guess over a long period of time, but investing is not a magic box that just spits out 7% in cash every year. There are major swings in the short-term, and it is up to the investor to stay disciplined and continue to hold their funds long-term. It is over a long period of time that the historical averages would begin to apply (although not a perfect predictor of the future) and the benefits reaped. Second, compound interest is nice when working for you, but it can also work against you in the form of debt interest. When you buy the biggest house you can possibly afford, that brand new car on a loan, credit card bills, or student interest, each one is collecting interest on top of interest you owe when you are only paying the minimum. I hope to go more in-depth about debt interest in the future but compound interest can both help and hurt.

Hopefully this information will encourage everyone to come up with a plan to invest early and often (while minimizing debt). The results of waiting just a few years to initiate investing are shocking and will hopefully dissuade you from letting the different demands on your money prevent you from investing early. Prioritizing investments when you have the opportunity, or working to make more money so you can work towards that opportunity, is important. In my next post, I will talk about where investment should be prioritized and ways you can manage your money successfully to have income to invest.